Tax Brackets 2025 Single - Single 2025 Tax Brackets Chart Leone, To help simplify tax season, we’ll discuss federal income taxes, including what income tax brackets are, how they work, important income tax terms, and other key insights to. 2025 Today Groblersdale High School. Dynamique private high school was…

Single 2025 Tax Brackets Chart Leone, To help simplify tax season, we’ll discuss federal income taxes, including what income tax brackets are, how they work, important income tax terms, and other key insights to.

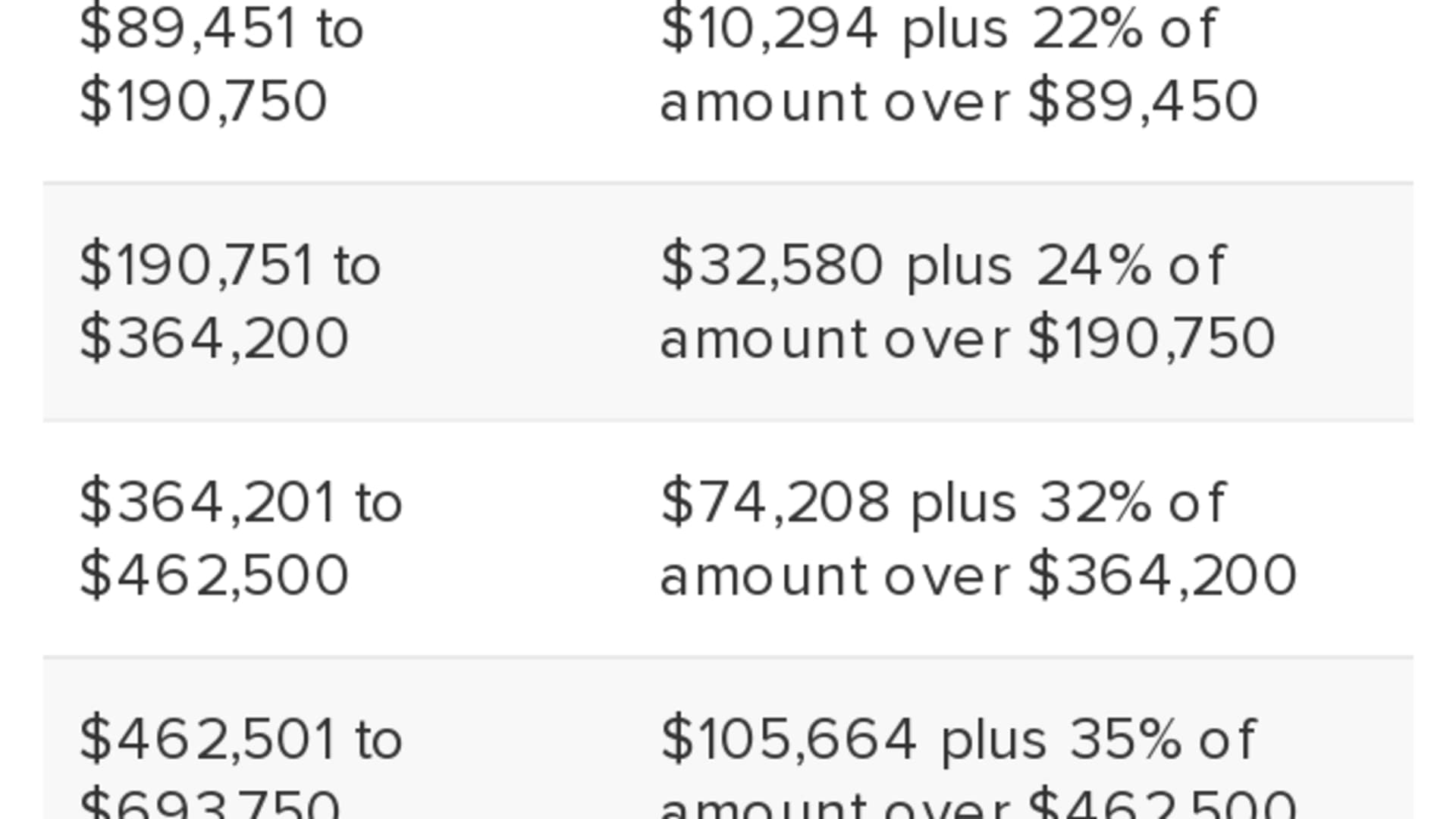

2025 Irs Tax Brackets For Single Filers Mirna Deloris, If you had $50,000 of taxable income in 2025 as a single filer, you’d pay 10% on that first $11,600 and 12% on the chunk of income between $11,601 and $47,150.

Tax Brackets 2025 Federal Irene Leoline, Federal tax brackets change yearly due to inflation adjustments, a process known as indexing for inflation. this prevents bracket creep, where inflation, not real income increase, pushes people into higher tax brackets or reduces the value.

Here’s how advisors are using Roth conversions to reduce taxes for, For single taxpayers and married individuals filing separately, the standard deduction rises to $14,600 for 2025, an increase of $750 from 2023;

Congressional tax bill and the new brackets The Bull Elephant, If tax planning is your thing, you’ll want to know what the 2025 tax brackets look like.

2025 Tax Brackets Taxed Right, If tax planning is your thing, you’ll want to know what the 2025 tax brackets look like.

2025 Chevy Silverado 2025 Accessories List. Below are just some…

What Are Federal Tax Brackets For 2025 Printable Form, How to file your taxes:

Tax Brackets 2025 Single. Your filing status and taxable. The rebate will be 50% of tax payable, capped at $200.

Standard Deduction For 2025 Single Over 65 Melli Siouxie, New irs tax brackets 2025.

2025 Tax Brackets Single Filer Nikki Analiese, Federal tax brackets change yearly due to inflation adjustments, a process known as indexing for inflation. this prevents bracket creep, where inflation, not real income increase, pushes people into higher tax brackets or reduces the value.